100 Quick Savings Tips.

Manage a budget, save money, think about your financial future ...

For most people, these topics are a big source of stress!

Still, it shouldn't be like that.

Indeed, know that there are simple and effective tips to save money.

To tip the scales in your favor, you just need to take a step in the right direction.

We have prepared for you this list of 100 easy tips to help you save money... and today!

How to do

Of course, these tips will not help you become a millionaire overnight.

But if you apply 10 or 15 the same time, these easy little techniques will quickly have an incredible impact on your budget.

Some of these methods are so simple that they take just 2 minutes to implement.

Others require a little more effort - sometimes an everyday effort.

But don't worry, because these 100 tips have one thing in common: they are all ultra-simple.

Of course, that doesn't mean that the entirety of these 100 tips are right for your financial situation.

The idea is to go through the list, then choose only 10 or 15 tips that you can easily apply to your current situation.

So, without further ado, here are the 100 simple tips to save big. Look :

1. Change bank to take advantage of welcome offers and reduce your fees

Do you pay monthly fees for maintaining your bank account?

If so, take the time to research thecheapest banks.

Indeed, to attract new customers, some banks do not hesitate to offer attractive welcome offers.

Thus, after opening a (free) current account and setting up a direct debit, these banks will pay you a premium of up to € 120.

And in terms of savings accounts, some banks also offer new customers bank passbooks with a much more attractive interest rate than traditional banks.

Even though interest rates are nowhere near as good as they were a few years ago, looking for a better rate is sometimes worth it.

2. Turn off the TV

Here's a great way to easily save money: spend as little time as possible in front of the TV!

Indeed, the financial advantages of watching less TV are numerous. Less TV, that means:

- fewer ads ... and, therefore, less incentive to consume,

- less electricity consumed,

- less spending on your subscription (if you switch to a free TV offer instead of a cable subscription),

- and above all: more free time. Time that you can use to do odd jobs and thus make ends meet.

And why not go even further and live without television? It’s not that complicated!

There are plenty of free things you can do instead of watching TV.

3. Instead of collecting ... sell!

Most collectors think their collection is going to pay them big.

We all remember the collections of pins, phone cards or other wacky objects ...

At the time, these objects were extremely popular and many people started collecting.

But today ? Well, these "precious" collections are resold at great loss at only a fraction of their original cost.

Now, you can find some in second-hand shops, garage sales or on advertising sites like leboncoin.

And of course, collectors are disgusted. Because there are many who have spent a fortune on their collection in the hope of making a profit. Ouch!

To avoid this kind of situation, avoid collecting objects ...

Your best bet is to sell all your trinkets on Leboncoin to limit your losses and make some money.

But if you can't sell them easily, don't waste your time and throw them away!

At least you will have made room in your house for more important things that you really need

4. Subscribe to free loyalty programs

These days, virtually all brands offer a free loyalty program, with benefits to encourage customers to consume in their stores.

Here's a little trick from Sioux to help you enjoy these benefits WITHOUT receiving dozens of spam emails to your inbox.

The trick is to create a dedicated email address, a Yahoo or Gmail email address that you will use only for loyalty programs.

The rest is easy, you use this address to subscribe to all the loyalty cards of the brands where you are likely to spend money.

And There you go ! Now, before making a purchase, all you have to do is open this address to take advantage of the latest offers and promotions at your favorite stores.

To discover : My Little Trick To Store Supermarket Loyalty Cards.

5. Instead of buying a gift for someone, give them something homemade

Save money or make a nice gift? The two are not necessarily incompatible!

Indeed, homemade gifts not only allow you to spend less money, but also offer unique and personalized gifts.

In terms of homemade, the choice is almost unlimited: click here to discover our best ideas for homemade products.

For example, here are some simple, inexpensive little things you can easily do at home:

- scented candles,

- a homemade photo album,

- a homemade chocolate fondant.

The little extra? Your loved ones will appreciate a homemade gift even more than a "traditional" gift.

Why ? Because it is a unique gift that was not bought in a store.

And most homemade gifts can be eaten or eaten.

Unlike a useless trinket, you can be sure that they will never be tucked away in a drawer and forgotten forever.

And for a little personal touch, also consider writing a nice note by hand and adding it to your gift.

6. Apply the 30 day rule

Avoid impulse purchases: this is THE golden rule for setting a good budget and better managing your finances.

And the best way to resist impulse buying is towait 30 days before deciding to make a purchase.

If this method is so effective, it's because in the majority of cases, you won't want to buy this item after a few days.

The other advantage is that by avoiding the purchase of an item that you do not have Actually need, you've saved some money.

Therefore, always wait 30 days before making a purchase, especially when it is a large purchase or something that you are not 100% sure you really need.

Thanks to the 30-day rule, you will have a clearer vision and you will be able to easily determine whether the purchase in question is worth it. really worth it.

If waiting 30 days seems too long, then at least try to wait 2 short days. In most cases, that's more than enough to stop you wanting to checkout. Check out the trick here.

7. Make a list before you go shopping - and stick to it

One of the easiest ways to save money is to have a shopping list.

Why ? Because by going to the supermarket without your little list, you expose yourself to the biggest enemy of piggy banks: impulse buying!

In fact, when you don't have a shopping list, you often end up cracking up and spending your money on unnecessary products.

The other advantage is that by sticking to your shopping list, you also avoid wasting stuff you didn't really need.

So, NEVER go shopping again without making a list.

And once at the supermarket, buy ONLY the products that are on this list!

To discover : Finally, an Easy-to-Print Shopping List Before Going to the Supermarket.

8. Instead of going to a restaurant, invite your friends over to your house

Going out into town to eat out can often blow your food budget AND your entertainment budget all at once!

The reality is that hosting a party with friends at home will be yours always cheaper than going out in town.

So, instead of going for cocktails in a bar or going out to a restaurant, plan a night out at home with your friends instead.

For the meal, practice the "Spanish inn" method, where each guest prepares and brings a dish.

And for the entertainment part, you can play a board game, watch a movie, etc.

You will see, this little tip will help you save money AND have a great evening with friends.

To discover : 32 Free Activities You Can Do Instead of Spending Your Money.

9. Fix your clothes instead of throwing them away

Don't throw away a shirt just because it's missing a button ...

Instead, take a thread and a needle, and sew the button back yourself.

Likewise, don't skip pants because of a small tear.

By patching it up with a piece of fabric, it will make ideal pants to wear while gardening or DIY.

And believe me, the basics of sewing are much easier than you might think! Discover 15 sewing tips here.

It's simple: by learning the basics of sewing, you can extend the life of your clothes by years AND save money.

To discover : 24 Sewing Tips That Will Make Your Life Easier. Don't Miss # 21!

10. Don't go broke to entertain your kids

For the entertainment of children, no need to make big expenses ... especially for young children.

Here are some original ideas to play with your children WITHOUT breaking the bank:

- Play ball in the garden.

- Take a walk in a forest.

- Do some gardening.

The most important thing is to understand what children really want: spend time with YOU, not with objects!

The result ? More joy in your heart - and even more savings in your pocket.

To discover : 20 Awesome Activities To Keep Your Kids Occupied During The Holidays Without Breaking the Ruins.

12. Sort through your things

Sort through the things that are lying around in your closet and all the cupboards in the house.

Take out all unnecessary items and clothes you no longer wear ...

But don't get rid of it just yet! Here, the idea is to try to make a small profit.

For example, a practical solution for selling trinkets and old clothes is to organize a garage sale.

Or even simpler, sell them in a consignment store, or on an ad site like leboncoin.fr.

The little extra? Freeing up space in your closet will take a hell of a load off you. You'll see, it's good for morale.

And if you manage to empty your entire cellar of unnecessary stuff, you can even rent it out on the Internet to earn you a little extra cash each month.

To discover : Earn Money Selling Items You No Longer Use.

13. Only buy video games with a long lifespan.

I love video games! The only concern is that they are more and more expensive ...

To avoid spending a fortune on video games, I only choose games with a long lifespan.

Games that I can play and replay for months on end and preferably games where the whole family can play.

That is, video games that can be replayed multiple times, even after beating them.

I particularly favor RPGs (role playing games or role-playing) because they have a lot of secondary scenarios that I can explore.

Now, I never buy new games until I have completely mastered the ones I already own.

Once you know a video game by heart, sell it on a classifieds site like leboncoin.

And with the money you earn, you can buy yourself another video game, but second-hand of course!

14. Drink more water (and less Coke)

The health benefits of water are widely recognized.

And the dangers of sodas, especially Coke, on your body are just as indisputable.

But did you know that just drinking more water every day can also help you save money?

Indeed, drinking a large glass of water before and after each meal increases the effect of satiety.

As a result, you are less hungry at each meal and therefore you eat less!

This means spending less on your food budget, while still enjoying the many benefits of good hydration.

It is therefore also a good way to go on a small diet easily without depriving yourself of the rest.

Also, by choosing to drink water at home or in a restaurant, you avoid unnecessary spending on expensive drinks like soda, juice, etc.

And don't forget: tap water is perfectly suitable for consumption ... and much cheaper than bottled water.

To discover : 11 Benefits of Lemon Water You Didn't Know About.

15. Avoid fast food and ready-made meals

During the lunch break, we tend to eat fast food or warm up a ready-made dish in the microwave ...

Instead, make yourself a nice, home-cooked meal the night before with healthy foods, which you can take with you to work.

Don't worry, making a great homemade meal isn't that hard.

During the weekend, you can prepare yourself a few meals for the week by multiplying the quantities by 4 (see point n ° 17 below).

In the evening, make easy recipes and bring back any leftovers for the next day at work.

Click here to discover all of our easy and inexpensive recipes.

And if you have an electric slow cooker, don't forget to use it!

This appliance allows you to prepare delicious recipes, like this great Chicken Stroganoff, while saving time AND money.

16. Please: stop smoking!

Are you a smoker?

So needless to say that this bad habit is not only extremely expensive, but also dangerous for your health.

If you want to add several years to your life AND save a bundle of money, the choice is obvious: stop smoking.

There are several solutions to say goodbye to the cigarette ...

For example, you can gradually reduce your consumption by using patches or an electronic cigarette.

Many people have successfully quit smoking all at once thanks to Allen Carr's book, The Simple Method to End Smoking Cigarettes.

Whichever method you choose, quitting smoking will help you save incredible amounts of money and improve your health.

To discover : The 10 Best Tips to Stop Smoking Once and For All.

17. Increase all quantities by 4 when making a recipe.

It's a simple trick, but you had to think about it!

The next time you prepare one of our easy recipes, increase the quantities by 4.

Then put the 3 additional portions in the freezer.

And there you have it, now you have a stock of homemade meals that you can reheat at any time.

Useful when you don't have time to cook during the week!

The other advantage is that this method allows you to save even more money.

Indeed, because by cooking your dishes in larger quantities, you can buy the ingredients in bulk and take advantage of promotions.

And because you always have good homemade meals on hand, it will also save you from wasting your money on fast food or industrial dishes.

To discover : 27 Things You Can Freeze To Save Money And Time!

18. Turn off the room lights as soon as you leave a room

Of course, at first glance, a light on by itself doesn't cost an arm and a leg.

However, over a year, its cost in electricity becomes considerable.

To save money, the rule is simple: as soon as you leave a room, remember to turn off the light.

And a fortiori, when you leave home!

Also consider educating your children to do the same as soon as they are old enough to reach for the switch.

Likewise, when it is still daylight, never leave a lamp on.

It is best to make the most of natural light.

To discover : 8 Easy Tips To Lower Your Next Electricity Bill.

19. Sell or trade your books, CDs and DVDs

Instead of keeping all your books, CDs, and DVDs that you no longer care about, why not just swap them with your friends?

You can also use sites like Bibliotroc.fr for books or Troczone.com for DVDs.

You can also try to make a small profit by selling them on an ad site like leboncoin.

Even better, get an inexpensive subscription to the media library, which allows you to borrow DVD movies and listen to CDs.

In the long run, the more you borrow and trade with others, the more you save.

20. Resist buying in flea markets and garage sales

Flea markets and garage sales are the perfect opportunity to get a good deal ... but only on the items you have really need, such as dishes, clothes, sports equipment, etc.

Be careful not to fall into the trap of unnecessary buying!

Indeed, it is not because an object is sold at a ridiculous price that you have to buy it!

The trick is to make a list of the things you really need. before to go to a flea market or a garage sale.

By limiting yourself to the items on the list, you are sure not to fall in love ... and you avoid making an unnecessary expense.

21. Use energy-saving light bulbs

With the purchase, a low consumption bulb has a higher cost.

But it has a longer lifespan and consumes much less electricity than a traditional incandescent bulb.

Note that there are 2 types of low consumption bulbs:

- CFL (compact fluorescent lamp): CFLs use 75% less energy than traditional light bulbs.

In addition, they have a longer lifespan of several years and remain the cheapest alternative after incandescent bulbs.

But they have 2 drawbacks: they take longer to reach their light output and contain mercury, although in small quantities.

Click here to buy them at the best price.

- LEDs (light-emitting diode): LEDs have a higher initial cost, although in recent years their prices have been steadily declining.

LED bulbs are truly THE best option when it comes to illumination.

They turn on instantly, are as efficient as CFLs, produce warm light and emit no heat.

In addition, they have a lifespan that spans decades.

Click here to buy them at the best price.

These 2 types of low consumption bulbs are a huge improvement over traditional bulbs.

One last tip: to save money, no need to replace all your bulbs all at once.

By replacing just 4 to 5 bulbs, you can already save a lot of money: up to € 45 in a single year.

To discover : The Guide to Low Consumption Bulbs Adapted to Each Room.

22. Use a programmable thermostat

Installing a programmable thermostat is a simple trick to reducing your gas or electricity bills.

By using the timer, you can set your thermostat to the perfect temperature when you are not at home or while you are sleeping.

As a result, you reduce your consumption and save a lot of money.

There are also smart thermostats, like the Nest.

Of course, this model costs € 250, but it will lower your heating bill by up to 12%, and your air conditioning bill by up to 15%.

To discover : 32 Energy Saving Tips That Work.

23. Choose household appliances with a long lifespan

Before purchasing any household appliance, it is important to do some research beforehand.

A reliable and energy-efficient appliance will of course have a higher initial cost.

But if this device helps you save energy and in addition it has a lifespan of 15 years instead of 5, you quickly realize that it is a good investment in the long term.

The idea here is always to always do research before buying a household appliance.

It's very simple: just take a tour of the media library in your neighborhood and consult the comparative tests of magazines such as What to choose Where 60 million consumers.

In just 1 hour of research, you will easily save hundreds of dollars in the long run.

24. Clean (or change) your car's air filter

Did you know that a clean air filter can reduce your fuel consumption by up to 7%?

Depending on the vehicle, this represents savings of up to € 100 every 15,000 km.

Plus, cleaning your car's air filter is much easier than it looks.

If you want to know more, just open the car owner's manual and follow the instructions.

And if your air filter is unrecoverable, then it's time to replace it.

You can find them for under $ 10 in most stores or even on the internet here.

To discover : Changing Your Car's Air Filter To Consume Less Gasoline.

25. Leave your credit cards at home

If you tend to mess around with your credit cards, you better not have them on hand!

So instead of keeping your credit cards in your wallet, store them at home in a safe place instead.

That way, you can always keep your credit card in case of an emergency.

The idea here is simply not to have your credit cards with you at all times.

Believe my experience, if like me you sometimes find it difficult to resist impulse credit card purchases, this method out of sight, out of mind can actually help you.

To discover : Money Tip: Pay with Cash and Not with Credit Card.

26. Plan your meals according to specials

To organize the menus and meals for the week, find the foods on sale by consulting the supermarket brochures and flyers.

Once you've spotted the best deals, all that's left to do is plan your meals around the specials and ingredients you already have at home.

By using this super-simple method for just a few months, you will easily reduce your diet budget.

To discover : 25 Foods You Must Never Buy Again.

27. Cheapest supermarket: do your own price comparison

Most people tend to shop at the same supermarket.

It's just a matter of getting used to, even when "their" supermarket may not be the one with the best prices!

Fortunately, there is an easy way to spot the supermarket.the cheapest :

- First, list the 20 foods and products that you buy most often.

- Then, when the time comes to go shopping, change your usual supermarket.

- Keep changing supermarkets every time you go shopping.

And you will see, over time, one of the supermarkets will quickly stand out: the cheapest.

This is the one that will become "your" new supermarket and help you save more money easily.

To discover : My Little Trick To Store Supermarket Loyalty Cards.

28. Use homemade products whenever possible

Yes, I admit it ... Before, I thought that the recipe for homemade bread was ultra-complicated and above all a big waste of time.

But after trying it, I realized that making your own bread is not only easy and much cheaper, but the bread is just right. delicious.

Since I adopted homemade bread, we never buy it again ... And another saving!

Here at comment-economiser.fr, we love recipes for homemade products.

Indeed, because the homemade helps to make big savings, but also to learn tons of new knowledge.

To discover : 46 Things You Should Stop Buying And Start Doing Yourself.

29. Avoid shopping to relax

Some people say there is nothing quite like a bit of shopping to relax after a hard day at work.

But, in reality, shopping to forget your stress is rarely a good idea.

Instead of wasting your money, you are better off finding free activities that don't involve unnecessary expense.

To eliminate stress, you can for example:

- play sports,

- do meditation,

- take a simple nap,

- to read,

- watch a movie or

- do some gardening.

Remember: in the long run, shopping will not be able to never reduce your stress.

30. Share your goals with your loved ones

This tip for saving money may seem strange to you ... and yet it makes perfect sense.

By sharing your ambitions with those you love, you will surely discover that you dream of the same projects!

So, find a project that you have in common, something ambitious and daring that makes you all dream!

The rest is natural ... When there are several, it is such easier to motivate yourself.

By sharing your dreams with your loved ones, you will be able to motivate each other to pursue your financial projects and turn them into reality.

31. Regularly check your household appliances

Regularly inspect the appliances in the house.

Here, the idea is above all to remove dust clusters that could interfere with the proper functioning of the devices, but also to check their general cleanliness.

Remember to take a look at the back of the devices and use your vacuum cleaner to easily remove the dust sheep.

Remember to check the air vents, especially those of the refrigerator, dryer and air conditioner.

If they are clean, dust is less likely to disturb the mechanical components of your devices.

Result, they work better, consume less electricity (which reduces the bill) and they have an extended lifespan (which saves you the cost of replacement).

To discover : 13 Simple Tips To Avoid Having Dust In Your Home.

32. Cancel subscriptions you no longer use

Have you subscribed to a gym, but you don't go too much?

The solution is simple!

When you are not 100% sure of the usefulness of a subscription, or do not take advantage of it often: you must terminate, without hesitation.

And if you are in doubt, remember that a termination does not involve any financial risk on your part.

Indeed, if one day you realize that you are really missing a subscription, all you have to do is resubscribe.

Know that you can very well play sports at home and without equipment!

The proof with these exercises to have a flat stomach in 6 min.

To discover : Standard Letter to Cancel your Mobile Plan and Avoid Automatic Renewal.

33. Buy second-hand items as much as possible

Today, refurbished products are commonplace!

We can find exactly the item we need (and often at an unbeatable price) in second-hand stores, consignments or on ad sites like Leboncoin.

You just have to get into the habit of thinking about second-hand items before going to a traditional store.

So when you have a purchase to make, take the time to visit first of all second-hand stores, or search classifieds sites.

For example, you'll find second-hand clothes at a fraction of their retail price, even if they've only been worn once.

By buying second-hand items more often, you will quickly save a lot of money.

In addition, you can now find electronic devices like smartphones and even TVs in very good condition on sites like backmarket or certideal.

To discover : Buying Used Books: The Smart Tip To Save Money.

34. Keep your hands clean

An ultra-easy tip to save money: wash your hands after using the toilet or touching raw food. The tutorial is here.

It's such a simple little gesture, but one that protects you from viruses, bacteria and potentially disease.

And less illness means less medical expenses, fewer work stoppages and no loss of productivity.

Be careful, that doesn't mean you shouldn't explore the world!

On the contrary, sometimes you have to know how to get your hands dirty to live enriching experiences.

The idea here is simply to keep in mind the basic rules of personal hygiene, as they can really save significant medical expenses.

To discover : 19 Great Tips For Staying Clean and NEVER Smelling Bad.

35. Remove your bank cards from online shopping sites

Spending money on the internet just got so easy, maybe too much easy !

It's even easier if you've saved your bank details to your Amazon account or iTunes.

The temptation is too great. A few clicks and the purchase is already made ... not even 1 minute!

The most effective way to break this bad habit is to simply delete your bank details from the site in question.

That way, the next time you're tempted to make a purchase, you're going to have to take the time to look for your credit card.

And it is precisely this little extra time that will allow you to think before going to checkout ...

Often, this small step will be enough to convince you that this purchase is not Actually necessary.

36. Give the best of all gifts: your time

Are your friends the parents of a newborn baby? Treat them to an evening of babysitting.

And if they have a pet, offer to take care of Cador when they go on vacation.

Another idea: offer to mow the lawns of friends who have just bought a house.

Believe my experience, your loved ones will very much appreciate these simple, but so caring, little gestures.

When our children were still young, we adored when a friend gave us an evening of babysitting ... much more than a "traditional" gift!

With this trick, you make your loved ones happy without spending money! Clever, isn't it?

To discover : A Clever New Way To Treat Yourself to Christmas Gifts.

37. Do your Christmas shopping AFTER celebrations

Shopping for the following year while taking advantage of the sales is a super effective tip to make big savings immediately!

You can save up to 80% of the prices if you do it right.

In addition, you can easily apply it to all celebrations.

The trick is simple. Wait a few days after a party, any one: Halloween, Valentine's Day, Mother's Day, etc.

Then, take advantage of the sales to make your purchases for the following year.

For example, buy an Easter egg decoration kit for a few days after Easter, and your Halloween decorations on All Saints Day.

The rest is simple ... all you have to do is put all your good deals aside, until next year.

To discover : When to Buy What? The Guide To Buying At The Best Price Month By Month.

38. Volunteer

Volunteering is a great way to meet new people and discover new things in your community.

But above all, it is the opportunity for you to participate directly in a positive project, a project that uplifts the spirit.

By keeping a positive attitude, volunteering can also be rewarding and entertaining ... without having to pay a single dime.

Every year, I dedicate more and more of my time to volunteering, participating in several associations within my community.

This is by far the best thing I have ever done in my life ...

Try and you will quickly understand. Click here to become a volunteer in an association.

39. Sort through your belongings

The principle is simple ... get rid of the unwanted items that clutter your house by trying to sell them to earn some money.

To start, go to a room in your house, any room.

Take each object that is there and ask yourself the following question: do i really need this stuff?

This object in your hands, does it really bring you happiness, or could you live very well without?

As soon as you find an item that you can get rid of, then sell it! Or donate it to an association!

It makes sense: because an object that brings you nothing will just clutter your house!

Surely other people need this item, and may be willing to pay money.

In addition, by doing these small sorts in each room, you can take the opportunity to do a big cleaning and save space in your home.

To discover : 6 Essential Tips To Make Room At Home Right Now.

40. Buy "first price" for basic products

We often tend to choose products from major brands, out of simple habit and also because of the ads ...

Instead, try “lower priced” products and private labels instead, especially for the basic products you buy often.

This is the case, for example, with pasta, rice, sugar, butter, milk, etc.

The price difference can go from simple to double!

And you will quickly find that the "lower price" products are in most cases of as good a quality as the products of the so called "big" brands.

In reality, the only difference is the marketing behind the big brands.

And I don't know about you, but I don't really want to finance the marketing budget of a multinational!

In the long run, you will drastically reduce your shopping budget just by buying "lower price" brands.

To discover : Shopping for Less: My Tip for Not Spending Too Much.

41. Prepare delicious meals at home

At first, use a super easy beginner cookbook.

I recommend the book by Jean-François Mallet: Extremely simple: The easiest cookbook in the world.

Of course, no need to buy your cookbook ...

Instead, check out your neighborhood media library, where you can borrow cookbooks for free.

Don't worry: cooking is much easier than you think!

But above all, homemade recipes are healthier and cheaper than the dishes offered in restaurants.

One last tip: when cooking, try to prepare your recipes usinglarger quantity.

Then put the extra portions in the freezer, as shown in step 17.

Now, when you're lazy to cook, all you have to do is reheat one of your homemade meals.

42. Choose term life insurance

Repeat after me: no, life insurance is not an investment !

Are you struggling to pay high premiums on permanent life insurance? Did you know you can change it?

In fact, permanent life insurance policies are by far the most common. But most of the time, they offer a low return on investment.

Instead, opt for term life insurance, which allows you to choose the length of your coverage between 10 and 40 years.

So you can use the money you save to pay off debt and build capital for other projects.

43. Choose a reliable car that uses little fuel

Thousands of euros: that's what you can save by choosing a reliable, fuel-efficient car.

Suppose your car has 100,000 km on the odometer.

By consuming 6 liters per 100 km instead of 10 liters, you save 4000 liters of fuel.

At € 1.40 per liter of unleaded 95, that represents savings of € 5,600.

And if you also drive a reliable car, you avoid repair costs, which further increases your return on investment.

Before choosing a car, take the time to do your research. For example, here you can find the models that consume the least.

And if it's not time for you to change your car, start eco-driving now!

How? 'Or' What ? By following our simple tips here to use less fuel on every trip.

44. Avoid malls like the plague

The mall is a place where you can stroll while window shopping ...

But it is also a place which overflows with temptation and which encourages consumption.

That is why it is advisable to avoid shopping malls at all costs, unless of course this is the only place where you can make a purchase.

Believe my experience, when you are on a shoestring, window shopping is outright torture!

To preserve your sanity, it is better to avoid this form of torture.

Instead of spending time in malls, try healthier entertainment.

For example, you can go for a hike, play a board game or watch a good movie at home.

To discover : 23 Great Activities to Do as a Couple WITHOUT Breaking the Bank.

45. Apply the 10 second rule

You have an item in hand, and you are about to put it in your shopping cart or to go to the checkout: STOP!

Take 10 quick seconds and ask yourself these questions:

Why am I buying this item? Do I really need it?

If you cannot find a satisfactory answer, put the item back on the shelf. As easy as that.

The 10 Second Rule is a quick and efficient technique that keeps me from making impulse purchases throughout the day.

46. Rent out unused spaces in your home

Do you have a spare bedroom that you are not using? So, why not rent it out on Airbnb or some other housing rental platform?

If you live in a city popular with tourists, renting unused space can dramatically increase your income.

Do not forget to inquire beforehand to fully understand the risks associated with this type of rental.

In particular, it is advisable to take the necessary precautions to protect your valuables and the privacy of your family.

Know that you can even rent your cellar and earn money every month by renting it on costockage.

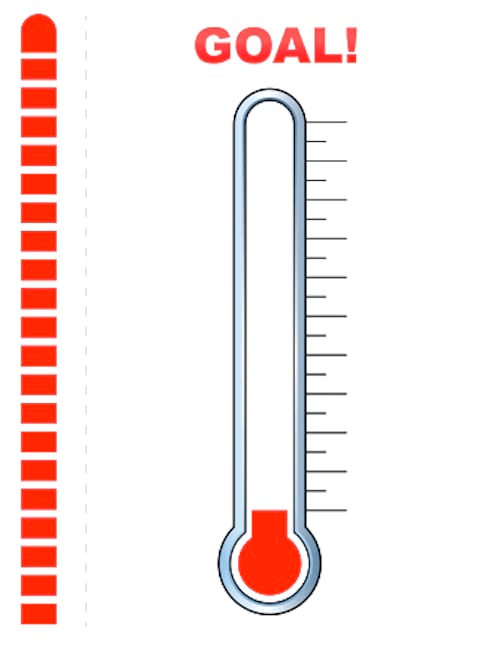

47. Draw a progress bar to better visualize your debts

To better understand your debts, it is essential to be able to visualize them.

A great idea is to simply draw a progress bar, like those on computers.

Your bar starts with the exact amount of all your debts and ends with zero, which is the repayment of all your debts.

Now, whenever you reduce your debt, remember to fill in your pencil bar to keep track of your progress as well.

The ideal is to hang your progress bar in a prominent place and use it as a reminder. And most importantly, don't forget to top up your bar regularly.

This method is effective because it helps you stay focused on the end result ... getting rid of all their debts.

To discover : 38 Tips To Better Manage Your Money And Never Run Out.

48. Cancel press, newspaper and magazine subscriptions

Do you have a large pile of magazines in your home that you still haven't read?

If it does, that means you are wasting money on a subscription that you are not using.

Therefore, do not renew the subscription in question!

Or even better: why not try to cancel this subscription and get a partial refund?

Indeed, be aware that most subscription contracts offer a pro rata refund in the event of termination.

Try to sort through your subscriptions and terminate the ones you don't read ... You won't regret it.

Especially today, you can find all the information you need for free on the Internet.

49. Eat breakfast every morning

A balanced breakfast gives you the energy you need to start the day right.

But a breakfast can also help you save money ...

By eating enough in the morning, you're less likely to buy a large (and more expensive) meal on your lunch break.

In addition, the ideal breakfast is easy to prepare and not expensive at all.

For me, a nice bowl of oatmeal with organic fruit every morning is THE best way to not spend too much money on my lunch breaks.

To discover : 7 Reasons Why You Should Eat Breakfast Eggs.

50. Co-babysit with the neighbors

In our neighborhood, there are several families with young children.

So to save money, we started exchanging evenings with other parents for babysitting.

The idea is super simple ...

Instead of paying for a babysitter, we entrust our children to a neighbor for the evening.

And, in return, we agree to take care of this neighbor's children for another evening. Awesome, don't you think?

Try to find 2 or 3 families in your neighborhood, people you trust and with whom you can exchange babysitting evenings.

Thanks to this method, you can enjoy romantic evenings without the children ... and also WITHOUT the expenses of babysitting.

To discover : Studies Show Grandmothers Who Babysit Their Grandchildren Have Better Mental Health.

51. Use your leftover dishes to make new recipes

For many people, eating leftovers is not a "real" meal.

Yet, there's nothing like reusing the leftovers from the day before for great savings ... and a delicious meal.

Fortunately, there are plenty of recipes to turn your leftovers into tasty and delicious meals.

Click here for easy recipes with leftovers.

My favorite technique? It's called the follow-up, and it involves using leftovers from yesterday's meal to prepare a new meal.

For example, by cooking your leftover meat (beef, duck or pot-au-feu meat), you can easily make a delicious shepherd's pie.

It will cost you next to nothing ... just a few cents to buy the potatoes.

To discover : 4 Easy Recipes To Cook Leftover Meat Instead of Throwing It Out.

52. Wear your clothes ... ALL your clothes!

Are you a shopaholic who wants to buy new clothes all the time? Then this tip is for you.

Take the clothes buried in the back of your closet and put them well forward.

And there, surprise! All of a sudden, you rediscover your forgotten clothes, and it's like having a new wardrobe.

Do you also have a chest of drawers? So, apply the same method: take out the clothes buried in the back of the drawers and put them in front.

Thanks to this silly little thing, you will have the impression of having "new" clothes ... but without paying a single penny.

It is your wallet that will be happy!

To discover : The Infallible Tip For Sorting Out Your Clothes.

53. Take your meals to work

Instead of spending your money every day on an expensive meal, why not just take your own meals to the office?

Maybe you don't think you have time to make take out meals every day?

So at least try to do it 2 or 3 times a week, it's already a great start especially if you do it every week.

In addition, preparing a good, healthy and tasty meal is really not complicated.

In fact, preparing a small meal the day before takes very little time, but it saves you big money, every week of the year!

And remember: if your coworkers criticize you for not having lunch with them in a restaurant, that's their problem, not yours!

To discover : Cheap Lunch: It's Possible and Easy.

54. Clothing: apply the minimalist method

When shopping, always choose clothes and accessories with a basic style, which you can easily match with your other clothes.

This is the method I use to reduce my clothing budget, while still keeping a professional look.

With only 5 pants, 7 shirts and 7 ties, you can easily combine your clothes endlessly. Check out the trick here.

I only buy clothes with a simple and timeless style, which I can match and re-match for in several different outfits and combinations.

And it is also the same method used by the great of this world like Zuckerberg or Steve Jobs at the time. Find out why here.

55. Ask for help and encouragement from those around you

When you feel unmotivated and you are unable to save money, take the time to reach out to your loved ones to ask for their help and advice.

Explain your financial goals to them and talk about your challenges in achieving them.

Tell them you'll love to hear their thoughts on this.

Then, listen carefully to what they have to say.

Your loved ones will bring their own perspectives, and these glimpses can surely enlighten you on the path to follow.

Indeed, these people know you better than anyone!

Even if they cannot help you directly, they will be there to listen to you, to understand how you are feeling and also to give you the moral support we all need.

56. Try to make your own repairs

Before, to repair everyday objects, you always had to call in a specialist.

But today, doing a home repair is a piece of cake!

On the Internet, you can easily find videos, tutorials, and tips online to fix almost anything. free.

No matter what item in question, it's well worth it to roll up your sleeves and try to fix it yourself, don't you think?

And if you really don't succeed, there are even sites that take care of fixing your broken items like this one.

To discover : The 37 Best Websites To Learn Something New.

57. Always keep a small notebook with you to write down your ideas.

We may have great ideas: if we forget them along the way, they are not very useful.

I used to waste a lot of time and money just because I forgot about my great ideas along the way.

The solution is to always have a small notepad with you, like this one.

That way, you can jot down all your good ideas and all the important things that come to mind during the day.

To discover : Do you take a lot of notes? Use This Tip To Keep Your Notebook Well Organized.

58. Buy a large freezer

Despite the initial cost, a large chest freezer can help you save a lot of money - but only if you use it regularly.

Unlike the limited capacity of the freezer compartments, chest freezers have a lot more space.

Thus, they allow you to make big savings by taking advantage of the best promotions to buy your food wholesale and cheaply.

And to save even more money, consider cooking your meals in larger quantities and freezing them for later.

That way, when you get home, all you have to do is take a tasty homemade meal out of the freezer and heat it up in three taps of a pot.

To discover : 27 Things You Can Freeze To Save Money And Time!

59. Try to move to a place where life is cheaper

For my part, I chose to move to an area where the cost of living is much cheaper.

Admittedly, this region offers less cultural activities, but I don't really have a problem with that.

Now, when I want to discover a bit of cultural heritage, I move!

I don’t hesitate to find cheap tickets and explore a new city or region.

After all, I can easily afford to take a little trip every now and then ...

Because now, I make big savings throughout the year thanks to my new region, where the cost of living is reduced.

And you, do you live in a super expensive city or region?

On closer inspection, are you really profiting from these additional expenses?

Sometimes moving is the solution that will tip the scales in your favor and save big money, instead of constantly having to make ends meet ...

To discover : The 10 Cheapest Cities in Europe to Travel Without Breaking the Bank.

60. Take advantage of free amenities in your city

The city where I live has beautiful parks, sports fields (football, basketball, tennis, etc.), hiking trails and many other free amenities available to everyone.

It is so easy to go out and enjoy all the amenities in your city.

Playing sports, cycling, hiking, walking ... all these activities are free !

Their only price is to take the time to discover them!

To discover : 35 FREE Activities to Do During a FREE Weekend!

61. Check your tire pressure

If your tires are underinflated by just 1 bar, you lose up to 1 full tank of gas a year.

Riding with properly inflated tires is like free fuel! It's worth it, right ?

Moreover, it is estimated that 2/3 of French people drive with under-inflated tires, which reduces their lifespan by 20%.

Yet avoiding this waste and wear and tear is so easy ...

Look in your car's owner's manual to find out and check your recommended tire pressure.

Then, go for a walk in a gas station, where you will be able to use their tire inflation gun with pressure gauge to check and correct your tire pressure for free.

To discover : Fuel Consumption: Check the Pressure of your Tires, Especially in Winter.

62. Make your own vegetable garden

Know that maintaining a vegetable garden to grow fruits and vegetables is an inexpensive activity.

So, if your house has a small piece of land, use it to create a vegetable garden.

You just need to rent or borrow a tiller to plow the land.

The rest is pretty easy: plant seeds and water your vegetable garden.

There you have it, in no time and with little effort, you have become a gardener, an economical hobby that pays big.

Indeed, because who says vegetable garden, says abundant harvests of good organic fruits and vegetables for the whole family!

In our garden, I grow good, big, tasty tomatoes. The tutorial is here.

Now, every summer is the harvest of delicious seasonal tomatoes. It is devoured in salads or in sauce.

But they are also used to make good tomato juice and homemade ketchup.

To discover : 23 Market Gardening Tips For A Successful First Vegetable Garden.

63. Use your city's cultural calendar

It's such a simple thing, but one that we tend to forget ...

All municipalities offer and organize free events.

A great way to take advantage of free activities in your area is to check the "Calendar" section of your local newspaper.

Another tip for staying informed is to check your town hall's website regularly.

Or, you can also go directly to town hall and request a listing of activities in your community.

Meals, entertainment, small gifts ... thanks to this technique, you will spot and enjoy lots of free stuff.

And above all, you will discover and get to know your community better!

64. Take public transport

Do you live in a city or town with a good public transport network?

So instead of driving to work, use public transportation to save a lot of money.

Indeed, taking public transport is much more economical than the car.

And what's more, you don't waste time looking for a parking space and making a tight time slot.

When I was still living in the city, I chose the annual pass to take advantage of the best public transport deals.

And believe me, this small investment pays off quickly: in just 2 months.

Amazing, isn't it? Compared to the expenses to go to work by car, that's 10 months of savings in the savings account!

It's like taking public transport free for the rest of the year ...

To discover : Top 10 Reasons To Cycle To Work (And Save Big Money).

65. Cut your hair yourself

This is a particularly effective method for those with a basic haircut.

For me, a simple stroke of the electric mower and the case is folded in 5 minutes flat.

Don't worry, getting your own haircut is much easier than you think.

Put some newspaper over the sink, take out the scissors, plug in the mower ... and get to work!

2-3 haircuts later, and you've already written off the cost of your mower.

Can you guess the rest? This means that after that, all your next haircuts are free.

Believe me, with just a little practice, the result is flawless.

And if you don't think you're going to make it, why not ask someone in your family who can help you?

To discover : Free Haircut and Hairdresser with a Haircut by a Friend.

66. Carpool

Do one of your colleagues live in the same neighborhood as you?

This is a great opportunity for you and your colleague to save fuel every day!

Offer to create a carpooling to make your daily trips together.

With carpooling, you save money And you reduce the wear and tear on your vehicle.

And if you don't have a colleague nearby, use a carpooling site to find someone easily.

I recommend this carpooling site which is 100% free.

67. Put in place a strategy to repay your debts

To get out of debt, you need an action plan.

Here is an easy method to help you find the right path:

The first thing to do is simply to list all your debts on a sheet of paper.

Then, the "strategic" part: prioritize the debts that you will repay first.

It may seem so obvious to some, but many people forget to prepare an action plan to repay their debts ...

You will see, it will quickly create a snowball effect: the simple fact of having prepared an action plan will motivate you to implement it!

In the long term, paying off your debts as quickly as possible is THE best way to save big.

To discover : Why I Use the 50/30/20 Rule To Budget EASILY.

68. Use an electric slow cooker

This is one of the best ways to reduce your diet budget, especially if you have a busy schedule.

With an electric slow cooker, also known as a food processor, preparing great homemade meals has never been easier.

Before going to work, we put all the ingredients in the slow cooker, we turn on the appliance, let it simmer slowly and you're done!

In the evening, you come home and everything is already ready: a delicious meal simmered to perfection!

There are tons of easy recipes for cooking with an electric slow cooker.

In addition, by using a food processor, you are sure to go out to restaurants less often ... even more savings.

The other advantage is that casseroles are even better when reheated ... They make perfect leftovers, yum!

To discover : How to Make Bread with a SLOW COOKER? The QUICK and Easy Recipe.

69. Maintain your home regularly

Instead of waiting for a device to fail to fix it, do spot checks yourself.

It's simple: every month, do a quick little check of all the devices and installations in your home (and also your car).

Then, if necessary, do the maintenance. Usually, this easy little gesture doesn't take more than an hour each month.

The big advantage of this method is that it will allow you to spot a possible anomaly before let it be too late.

Thus, you prevent your devices from breaking down and requiring costly repair ...

And remember, in the long run, maintaining your home well will also increase its value.

To discover : 13 things no one has ever told you about owning a home.

70. Buy your basic products in bulk

For the commodities you use most often, always buy in bulk.

And especially when it comes to non-perishable products such as diapers, toilet paper rolls, sponges, laundry, garbage bags ...

This is the best way to take advantage of good promotions on product bundles.

Buying wholesale products significantly reduces their unit price.

And in the long term, this technique allows great savings.

To discover : 5 Products You Must Buy Wholesale To Save.

71. Prepare snacks before your long car journeys

Before a long drive, consider packing sandwiches or snacks to snack on during the trip.

Convenient, as it will save you the time of wasting time looking for a restaurant on the road and spending your money there.

Because restaurants and gas stations on the roads are often overpriced!

With healthy little snacks prepared in advance, you can easily eat on the go.

Or even better, take a break to snack on your meal on a motorway rest area. It's a great opportunity to stretch your legs.

Also avoid succumbing to processed foods offered at gas stations.

They are not only bad for your health, but also expensive.

To discover : 18 Indispensable Tips For Your Long Car Trip.

72. Adapt your mobile plan to your needs

Nowadays, mobile plans have become more and more competitive.

To make the most of their advantageous offers, take a few minutes to look closely at the invoice for your current plan.

Why ? Because often our mobile plans do not match Actually to our needs.

In fact, it is very likely that you are paying for services that you use little, if at all.

Therefore, do not hesitate to change provider: take the time to do your research and find a cheaper plan.

At the moment, I advise you to look on the side of Red By SFR which offers very competitive rates.

To discover : The 10 CHEAPEST Mobile Packages on the Market.

73. Consolidate your debts with a credit consolidation

Interest rates have been pretty low lately ... so you might as well take the opportunity to consolidate your debts.

A credit consolidation consists of consolidating your various debts and credits, by grouping them into a single credit.

Usually, this new loan is rescheduled over a longer period.

The great advantage is that this allows you to assume a single monthly payment, which reduces the monthly repayment charge.

For example, suppose you consolidate $ 10,000 of debt into one loan.

By obtaining a reduction of 1% on the interest rate, you are already saving € 100 per year.

And if you're like me, your credit is well over € 10,000 ...

This means that you can surely get an even better reduction on the interest rate.

To discover : ALL French Banks Practice Tax Evasion EXCEPT This One.

74. Never buy a new car

It's a fact: Buying a new car is a bad investment.

Why ? It’s because of depreciation.

Indeed, a new car loses 30% of its value from the first minute of its purchase.

And it continues to lose value every month of the year.

So, to save as much as possible on your transport budget, only look for used cars in good condition.

Ideally, find a used car that is no more than 1 or 2 years old, as it will still be covered by the manufacturer's warranty.

To discover : 4 Effective Tips For Buying A Cheaper Car.

75. Take advantage of the free media library services

Media libraries are no longer places where you go only to borrow novels ...

Nowadays, the media library has turned into a place where you can do all kinds of things ... free.

For me, it has become a place that I visit regularly, almost every day.

For example, to borrow a DVD, a CD, read the newspaper or leaf through the latest journals and magazines ...

But also to learn a foreign language, meet new people, use a computer or consult the agenda of free events in the region.

The icing on the cake ? It's that I take advantage of all these services without spending a single penny. Awesome, don't you think?

76. Use a simple, basic and inexpensive razor

I have been using a simple and basic razor for several years now: the famous safety razor, also known as the safety razor.

To save even more money, I shave in the shower, which allows me to use my soap as shaving foam.

Here, the idea is mainly to use a razor model basic.

Stop buying those expensive electric razors that don't work after a few years.

Likewise, avoid multi-blade razors, as replacement blades get more and more expensive.

And rest assured, safety razors give great results ... Adopt it and you save big in the long run.

To discover : The Tip To Save A LOT of Money on Razor Blades.

77.Find the inspiration that motivates you to save

For me, they are my children. They are the ones who inspire me to save on a daily basis. It is for them that I try to improve myself.

For my best friend, it is in his relationship that he draws all his strength and inspiration.

Your inspiration can also be a personal goal, such as retiring as early as possible.

Whether it's a person or a goal, find your inspiration - what motivates you to to act to improve your life.

Afterwards, the idea is to think of your inspiration as often as possible by putting pictures of her everywhere: in your wallet, in the car, in the bathroom mirror ...

To discover : 85 Inspirational Quotes That Will Change Your Life.

78. Find out about all the benefits paid for by your employer

At work, go talk to the personnel and human resources manager.

Tell him you want to know more about all the services and benefits paid for by the company.

Believe my experience, I am sure you will make some great discoveries.

For example, know that your employer is required to cover part of your transportation costs.

This is also how I learned that I benefit from several reductions: gym, cinema tickets, etc.

I even learned that my employer could finance training.

Thanks to these advantages, I was able to follow interesting training courses for my personal development, and I also considerably reduced my entertainment budget.

79. Make your own cleaning supplies instead of buying them

We don't necessarily realize it, but household products cost a fortune if we add up over the year!

With basic products like baking soda, white vinegar, and black soap, making your own household products is super easy.

This is an extremely simple method that will save you incredible amounts of money on the purchase of cleaning products.

Check out these easy, natural, and inexpensive recipes:

- recipe for multi-purpose cleaner

- recipe for homemade window cleaner

- homemade Febreze recipe

- homemade laundry powder recipe

- homemade fabric softener recipe

- recipe for dishwasher tablets

80. Choose free activities for your outings with friends

Offering a free or inexpensive activity to your loved ones can sometimes be tricky.

Fortunately, there is an effective way to convince your friends to choose a place or an activity ... without exploding your entertainment budget.

The simple trick is to be the first to suggest an activity for your group.

Often, just being the first to suggest an activity is enough to decide the group.

For example, instead of going to a pool table in a bar, instead suggest to your friends to go for an aperitif-pétanque in a park.

To discover : 32 Free Activities You Can Do Instead of Spending Your Money.

81. Don't drive too fast

Why ? Because when you drive too fast, you consume more fuel!

By exceeding the speed limit, you also risk a big fine because of the more and more frequent speed cameras.

Be aware that the fines for speeding are particularly steep.

But that's not all ... if you get a fine, your insurance premium will go up too.

To save money, always obey the speed limits.

This is the best way to consume less gas and avoid getting a fine.

To go further, I even drive 20 km / h slower than the speed limit.

To discover : Eco-Driving: Drive Slower To Save More.

82. Read more often

Reading is one of the cheapest forms of entertainment and has incredible health benefits.

Almost all cities have a media library open to the public.

So, take advantage of your media library: go borrow books for free on subjects that stimulate and interest you.

The rest is easy. Sit in the most comfortable place in the house and let yourself be carried away by the story of your book.

With reading, you learn new things, you increase your intellectual capacities and you enjoy a good moment of relaxation ...

And without spending a single penny!

To discover : The Incredible Benefits Of Reading That Everyone Should Know.

83. Buy a small house

While you can afford to buy a large house, it is better to invest in a small house.

Currently my wife, our 2 children and I live in a 100 m² house.

Frankly, this house is quite spacious enough for our needs!

Some people could not live in less than 200 m2, but we are more than enough.

Indeed, we spend most of our time together in the same room.

The reality is, you don't need a huge amount of space to feel comfortable.

Instead, it's better to buy a modest-sized house and fill it as little as possible with unnecessary stuff.

With a smaller house, you'll be happier ... and you'll have more money in your bank account.

To discover : 12 Reasons You'll Be HAPPIER in a Smaller House.

84. Change route to go or come home from work

Do you like having a little coffee on the terrace before going to work?

Or maybe you take the return trip to window shop at your favorite stores?

To avoid the temptation to make such unnecessary purchases, simply try changing your route to and from work.

And it doesn't matter if this new route is a little longer than your usual journey.

This method will allow you to avoid the places where you are used to making unnecessary purchases.

By eliminating these expenses, you will quickly save more every day of the week.

To discover : Better than Coyote and GPS combined: the Free Waze Smartphone App.

85. Negotiate always registration fees and to request reductions

Are you going to take out a new service or a new subscription?

So ask systematically that the registration fees are waived. Make it a rule!

And fear not, making this type of request is much easier than you think.

Just be frank and direct: just ask for a gesture of goodwill, because you don't want to pay excessive fees.

Of course, it doesn't always work. But, quite often, your request will be granted.

Recently, I changed Internet provider to take advantage of a more interesting offer.

By requesting a gesture of goodwill as a new customer, I easily got the registration fee waived.

And it works just as well for condominium fees as fruit and vegetables on the market or even the renewal of your laptop.

To discover : What if we dare to ask for discounts?

86. Don't waste your money on branded hygiene products

Most studies prove it: a "budget" hygiene product is as effective as a brand name cosmetic that costs a cup.

For me it is very simple. I buy always the cheapest, whether it's toothpaste, deodorant or any other personal hygiene product.

As for my wife, she makes all these cosmetics herself to avoid toxic ingredients.

If we use these products, it is to have good hygiene, regardless of the price!

As long as you take showers regularly, you will not no problem.

Why pay 30 € for a luxury exfoliant when the result will be even better with a little coconut oil and baking soda?

To discover : Bicarbonate + Coconut Oil: The Best Cleanser For Problem Skin.

87. Eat less meat

Everyone knows that meat is expensive. But is its high price really justified?

Well, comparing the nutritional intake of meat to that of fruits and vegetables ... not really!

Indeed, several staple foods, including starches, also have a high protein content ... but at a much more interesting cost.

Even if you are not yet motivated to become a vegetarian, try to eat less meat.

Replacing meat with foods high in protein is an effective way to save extra money.

To discover : The 15 RICHEST Foods in Vegetable Protein.

88. The very simple trick to save on heating: put on a sweater!

When temperatures drop, many people tend to turn up the thermostat.

However, we tend to forget one of the basic reflexes before increasing the temperature of the radiators: put on a good old sweater !

The more we cover ourselves, the less cold we are, the less heating we use, and the less money we spend! Rather logical, isn't it?

So you can easily avoid overconsumption of heating in winter ... and save money on your energy bills.

To discover : The Ultra Simple Trick To Save On Heating.

89. Fix air leaks in your home

If your house has an air leak, you use more energy to cool it in the summer and warm it in the winter.

Why not reduce your energy bills by caulking the air leaks in your home?

Take an afternoon to spot any air (and money) leaks in the house, and patch them up for good with expanding foam.

And for the door that lets air through downstairs, a simple homemade sausage does the trick. Find out how to do it here.

To discover : 14 Tips That Will Lower Your Heating Bill EASILY.

90. Drink home-made beer or wine

If you like a little drink every now and then, here is a great tip for sipping your favorite drinks for less.

Be aware that producing homemade beer and wine is really easy.

In reality, once you master the basics, it takes very little time and effort.

The added bonus is that it's a great activity to do with friends.

You can invest in a beer or wine making kit, and your friends can take care of the necessary ingredients.

Once the production is finished, everyone can drink a little mousse or a glass of wine!

Good times with friends having a drink free : isn't life beautiful?

To discover : The 8 Scientifically Proven Health Benefits of Red Wine.

91. Protect your electronic devices against lightning strikes

It is above all a matter of protecting expensive electronic devices: TV, amplifier, hi-fi system, computers, etc.

Why protect them? Be aware that in the event of a power surge, electronic devices can easily be destroyed.

To avoid this danger, plug all your devices into a power strip equipped with a surge protector, like this one.

Did you know that devices on standby continue to consume electricity?

To avoid this type of "vampire consumption", also remember to unplug your devices when you are not using them.

To discover : 7 Simple Tips To Lower Your Electricity Bill This Summer.

92. Choose automatic debit to repay your student loan

Most student loans offer a reduction the interest rate if you choose direct debit to pay the monthly payments.

It's an easy little trick to save some extra money, but also to save time.

And yes, because you no longer need to make online transfers every month!

Thanks to this trick, my wife and I saved € 60 per year.

93. Go on a cheap vacation

Instead of taking long trips that blow your budget ...

... why not just explore the most beautiful sights in your area by car?

And believe me, you don't have to overspend for an unforgettable family vacation.

When I was still a child, my parents put the camping kit in the trunk and we set off with the family to explore the country.

It was awesome. For a week, we visited the most beautiful regions of our part of the country.

And in the evening, to sleep, we pitched the tent on a campsite or next to a lake.

These short vacations brought us only good memories ... and with very little expense.

To discover : 23 Travel Tips Even Frequent Travelers Don't Know.

94. Cancel your TV subscriptions

Many people pay for a TV subscription without really taking advantage of the hundreds of channels offered this type of offer.

For example, with us, for (too) a long time, we paid for a satellite TV offer.

The subscription was more expensive ... But since you could watch a movie when you wanted, we really thought we were getting a good deal.

Except that in reality, we only watched premium channels 2 or 3 times a month.

Today, we understood that it is better to borrow DVDs from our neighborhood media library.

To avoid unnecessary expenses, choose a TV subscription that really meets your needs.

Some basic offers offer around thirty channels for less than € 5 per month!

To discover : The New Trick To Watch Movies Online For Free.

95. Exercise a little more

In the evening, when you come home from work, go for a walk or jog to let off steam.

Or try these stretching sessions that relieve lower back pain and hip pain.

And why not try this challenge to have abs and beautiful buttocks in 30 days?

The big advantage is that these exercises allow you to enjoy the incredible benefits of physical activity, but for free and without even leaving your home.

Besides, it's so easy! A few minutes a day are enough for a good fitness.

Believe me, it's your body (and your wallet) that will be grateful!

It is much cheaper than going to buy weight loss devices or take out a subscription to a gym.

To discover : Take The Challenge: 4 Weeks To Lose Your Little Belly And Get Abs.

96. Pay all your bills online

The number one reason to pay your bills electronically is that it encourages you to take a closer look at your account balance.

As a result, you are less likely to find yourself short and thus avoid having to pay premiums.

The other good reason is that it also saves you small unnecessary expenses like envelopes, stamps or ordering a new checkbook.

And nowadays, paying an invoice online has become super easy ...

You just have to fill out a small form, and after that you can pay all your bills with just one click.

In addition, it saves time compared to a letter that you receive by mail.

97. Use a smart power strip to plug in devices that consume more electricity

Did you know that some devices continue to consume power even when they are turned off?

It is estimated that these "vampire" devices represent 5 to 10% of household electricity consumption.

But with a smart power strip like this, you can set up a program to turn all your devices on and off via an app.

Once the sleep mode is programmed, the app takes care of the rest: it is it which automatically turns your "vampire" devices on and off.

With this power strip, you save on your electricity bills and you reduce your energy consumption.

To discover : 7 Simple Tips To Lower Your Electricity Bill This Summer.

98. Accept failure and learn from your mistakes

When we make a bad decision, we all tend to blame ourselves ... and sometimes for a long time.

Instead, after failure, try to understand your mistakes and learn from them.

When you realize you've just made a bad choice, it's important to understand what kept you from seeing that your decision was wrong.

So, understanding what happened before to make a bad choice, you will surely avoid making a bad decision in the future.

Always remember that failures are just one step towards achieving your goals.

Somehow, chess can help you, because it is thanks to it that you will learn the mistakes to avoid!

By applying this strategy throughout your life, you will make fewer and fewer mistakes.

As a result, you will more easily avoid stinging financial failures.

To discover : 13 Things Mentally Strong People Never Do.

99. Don't cling to the past anymore

Don't let the mistakes of the past drag you down. Otherwise, you risk making even more bad choices!

Instead, look to the future.

Always remember that mistakes are essentially life lessons that keep you moving forward.

Whether it is a success or a failure, we always have a life lesson to learn from our experiences, both good and bad.

So do not run away from the mistakes of the past ... accept them and move on !

Look to the future, find new life goals, and keep your mistakes where they belong: in the past.

To discover : The 10 Things You Absolutely Need To Stop Worrying About.

100. Don't turn down never arms !

There are days when getting out of it seems insurmountable ...

When this is the case, always remember that you are not alone.

Many people are also engaged in the same fight as you!

So, to cheer yourself up, come read a little article on comment-economiser.fr and join our community by leaving us a message in the comments.

Perhaps you will discover new tips for getting out of a difficult financial situation.

Take this opportunity to read the testimonials of other readers to help you persevere no matter what.

To discover : 12 Toxic Thoughts To Avoid For A Better Life.

Your turn...

Have you tried these tips and tricks for daily savings? Tell us in the comments if it worked for you. We can't wait to hear from you!

Do you like this trick ? Share it with your friends on Facebook.

Also to discover:

17 Quick Tips To Save A Lot Of Money.

44 Ideas To Help You Save Money Easily.