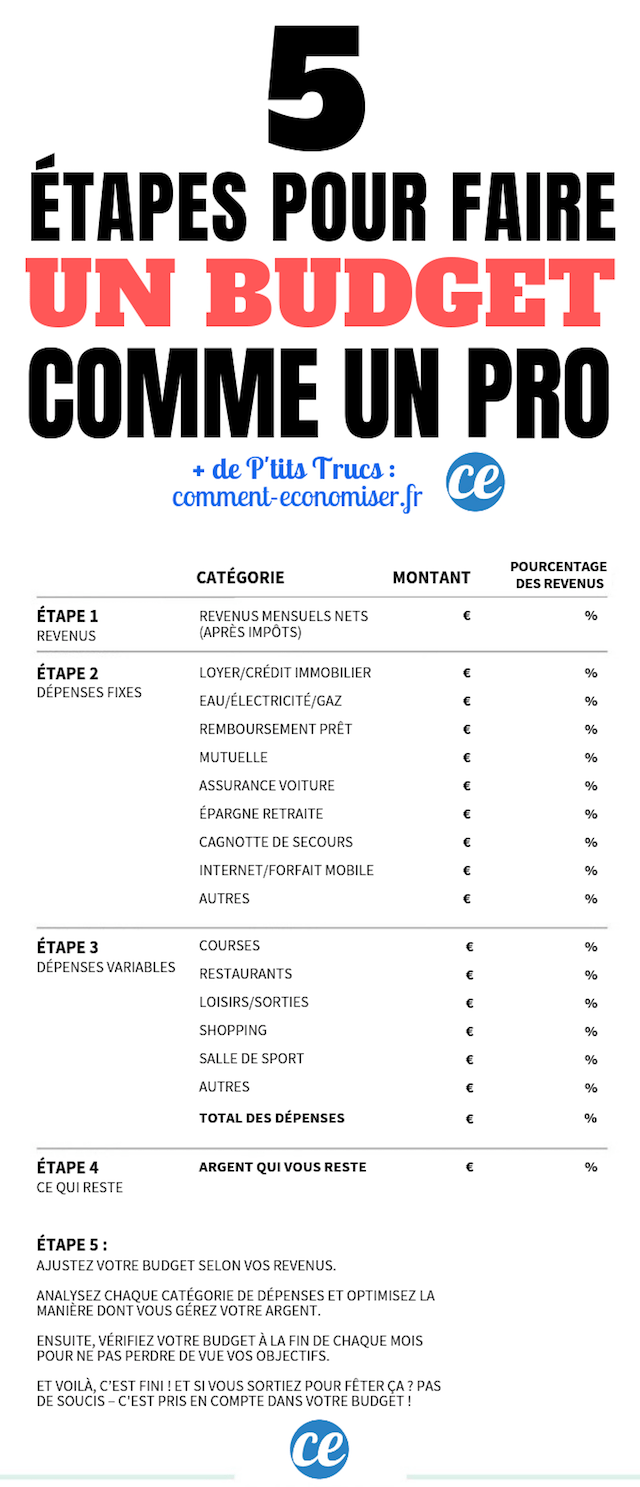

How to Budget LIKE A PRO In 5 Super Easy Steps.

Is making a budget too complicated?

It is true that most of the methods are difficult to set up ...

But no need to navigate in total fog!

Not only does it cause stress not to know how much you will have left at the end of the month ...

... but in addition, you risk being overdrawn and having to pay outrageous bank charges!

Fortunately, there is a simple and effective method to budget like a pro in just 5 easy steps.

All you need to be able to manage your money better on a daily basis is to follow this easy guide. Look :

Click here to easily print this guide in PDF format.

Step 1: calculate your monthly net income

The first step is very simple.

Just look at your last payslip and calculate your monthly income.

This is simply the amount that is paid into your bank account each month, after deducting taxes.

With withholding tax, you no longer have to calculate anything.

In fact, from January 1, the tax is automatically collected by your employer or your pension fund.

If you are self-employed, look at your income for the last 5-6 months to get a reliable estimate of your monthly income.

Step 2: list your fixed expenses

Now make a list of all your fixed expenses, the ones that are really impossible to cut.

These are all the expenses that you have to pay each month, because they are simply essential to (survive) a living.

This includes: rent, charges related to housing (water, electricity, gas) or expenses related to the car (insurance, parking, fuel).

In this list, also add the money you want to set aside each month to build an emergency fund.

When listing all of your expenses on the budget, remember to put each expense in a separate category.

Why ? Because it's much easier to track each expense when you know what category it belongs to.

Don't forget to put all your fixed expenses, including those that are not billed monthly, such as home insurance.

For example, if you pay for one of your insurance policies twice a year, calculate the total amount you pay in one year, then divide by 12.

Another example: if your electricity and gas bills vary a lot from month to month, add up everything you paid for a period of 12 months, then divide that amount by 12.

Step 3: list your variable expenses

Now, it's time to list all of your other expenses.

These are expenses that are not essential for living, namely variable expenses.

These can change from month to month.

It is for example a shopping session, a brushing at the hairdresser, a subscription in the gym or even expenses related to outings.

Spend all your expenses Review, including those that may seem trivial like a movie ticket, daily coffee, buying an app on your phone, etc.

Indeed, it is by doing this sorting that we can identify the small expenses that are in reality real black holes in a budget!

Take care to list all your expenses in separate categories.

The goal here is to be able to estimate your variable expenses as accurately as possible. And to be successful, the key is to keep track of your spending habits.

If listing your expenses seems too complicated, know that there are some great apps for managing your budget.

In particular, I recommend Bankin ’, an application developed by a French start-up!

Once this type of app is connected, your expenses are automatically categorized.

You easily discover how much you spend on groceries, shopping, restaurants ...

No need to do your math, because you have months of spending data at your fingertips.

Now you can review your spending habits. The goal here is to find a reasonable amount for all that unnecessary expense.

Identify the categories where you spend the most money and ask yourself the following 2 questions:

- are they really necessary to live?

- what are the expenses of which you could reduce the cost?

This sorting makes it possible to prioritize the expenses according to the needs, that is to say to identify the expenses which are not not indispensable.

Step 4: calculate what you have left

Thanks to steps 2 and 3, you have calculated your monthly expenses, fixed and variable.

Just add up to get the total of these expenses.

Now calculate the difference between your income and your total expenses.

You get what the experts call the disposable income. Simply put:

Disposable income = Monthly income - Total expenses (fixed and variable)

This is the money you have left in your pocket after all your monthly expenses, including "sustainable" expenses like rent, but also "variable" expenses like shopping.

Ideally, this is the amount you will use as the basis for building a budget and achieving your long-term goals.

For example, you could put that money aside to buy a house, or to finance a small retirement fund.

Your goal, of course, is toincrease your disposable income.

But the true the secret to managing your money well is knowing how to dispatch as much of this reserve as possible to your saving.

Basically, it's the savings that should get the better of your spending!

Pick an amount to save each month, then try to see what expenses you could reduce.

We all have many shopping desires and temptations, but our disposable income is limited.

So, it's up to you to find the balance between your current expenses and your savings needs.

The only rule to keep in mind is to try to never spend more money than what you earn.

But how do you get there? To properly distribute your money between your savings and your expenses, do one of the following:

1. Try to reduce all of your variable expenses to a reasonable amount (eg 15% of your income).

WHERE

2. Try to target the main categories of expenses on which you can make significant savings.

Step 5: assess and adjust your budget

This is the last step, but also the most important.

Now calculate the allocated percentage to each category of your budget.

Then take a close look at your budget ... very closely. Analyze it, study it, dissect it!

Now is the time to sort out your spending, the way you manage your money.

Are the percentages allocated to expenses reasonable in relation to your income?

Are you happy with the amount you save each month?

How to better distribute your budget?

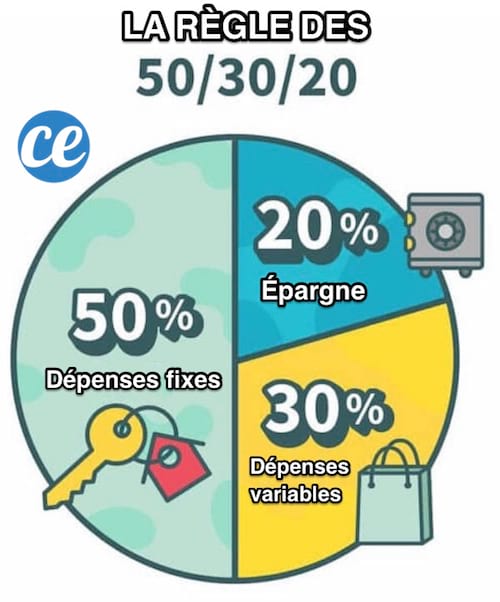

Follow the 50/20/30 rule

The most effective method of allocating your budget is the famous 50/20/30 rule.

You will see, the principle is ultra-simple.

Just divide your income into the following categories:

- 50% of your income for fixed expenses (charges, rent, insurance, etc.)

- 20% for savings or the repayment of debts and

- 30% for variable expenses, like going out, shopping, but also food.

Results

And there you have it, you now have how to budget like a pro :-)

Easy, fast and efficient, isn't it? :-)

In 5 easy steps, you can now determine the ideal budget to put in place - one that matches your spending and financial goals.

Do you feel motivated? Ready to know exactly how much money you spend (and save) each month?

So know that it is never too late to take matters into your own hands and get your finances back on track !

All you have to do is print the guide and fill in the blanks.

You will see, this guide is like a plan - a plan to help you get out of the maze.

And once your budget is calculated, test it! This is the only way you can see if you have set realistic financial limits and goals!

Some tips for success

- As mentioned above, experts advise using a budget management app, like Bankin ’. This type of application will help you easily track your spending and above all never lose sight of your financial goals.

- Take 30 minutes at the end of each month to review your budget against your spending habits.

- Managing your budget is a work of learning, a work of improvement. So make small adjustments to your spending categories and savings goals, until you find a totally CUSTOM and, most importantly, ACHIEVABLE budget.

- To help you easily establish your family budget, you can also use this handy notebook to track expenses.

Your turn...

Have you tried this trick to budgeting in 5 easy steps? Tell us in the comments if it was effective. We can't wait to hear from you!

Do you like this trick ? Share it with your friends on Facebook.

Also to discover:

The Weird Trick I Use EVERY MONTH To Stop Going Over My Budget.

Make a Personal Monthly Budget to Save Money.